Time is money, and if you own commercial real estate that is worth $ 500,000 or more, a cost segregation study could free you up the next time you file your next tax return.

BeachFleischman provides cost separation services to its customers nationwide and we have offices in Phoenix and Tucson, Arizona. We advise commercial property owners to increase cash flow, reduce their tax liability and review missed deductions. We have the experience and technical knowledge to conduct studies with favorable results that are compliant with IRS guidelines. In addition, our specialists are very familiar with real estate tax law, tax depreciation and tax issues relating to cost separation. We work with qualified engineers to ensure that our clients get the maximum tax benefit allowable for every study we conduct.

Why invest in a cost separation study?

Ashley T. Byma is BeachFleischman’s Senior Tax Manager.

• A cost segregation study is a special method used to accelerate commercial property depreciation, which generates increased cash flows.

• An engineer conducts an on-site visit of the property to determine how parts of the building can be redeployed into shorter depreciable useful lives (e.g. 5, 7, and 15 years); compared to the typical depreciation periods of 27.5 or 39 years that are allocated to residential or commercial properties.

• Shifting portions of the original depreciable useful life into properties with a shorter life will generate significant tax savings and cash flows from this accelerated depreciation. Estimate the tax savings of your property with our cost separation calculator.

• BeachFleischman offers comprehensive studies on cost separation. We implement the study from start to finish in coordination with the engineers and deliver comprehensive results that you can incorporate into your tax return.

How much can the tax savings be worth?

• The tax saving depends on the structure of the building, how it is used and when it is commissioned. These factors will affect how the depreciable lives are reallocated.

• If the property was put into operation several years ago, the reassignment of the depreciable useful life can usually be adjusted in the current year without changing the previous tax return. This can result in immediate tax savings for the owner (s).

• Test our cost separation calculator to find out how you can generate significant cash flow in the form of tax savings.

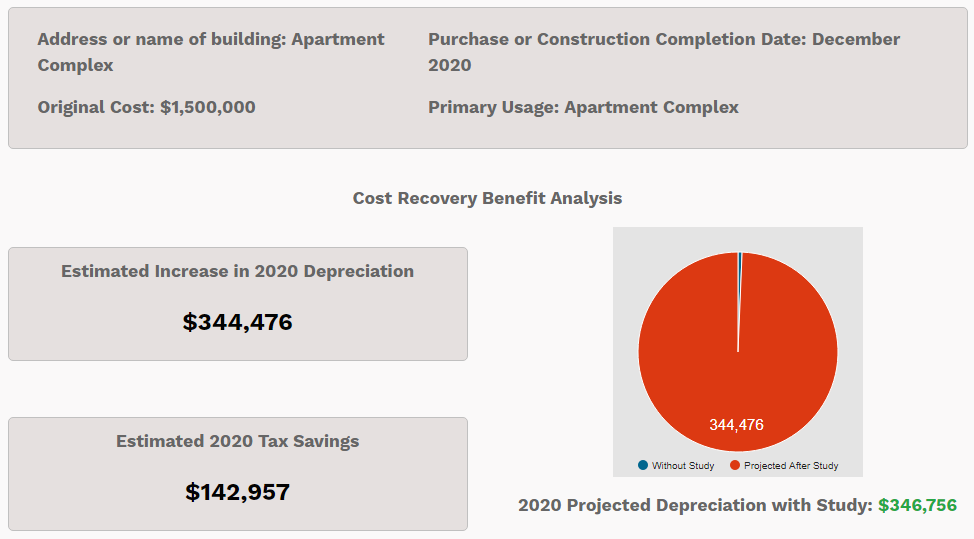

• Below are sample study results from our calculator for a $ 1,500,000 apartment complex that went online in December 2020. The tax savings for 2020 are approximately $ 143,000.

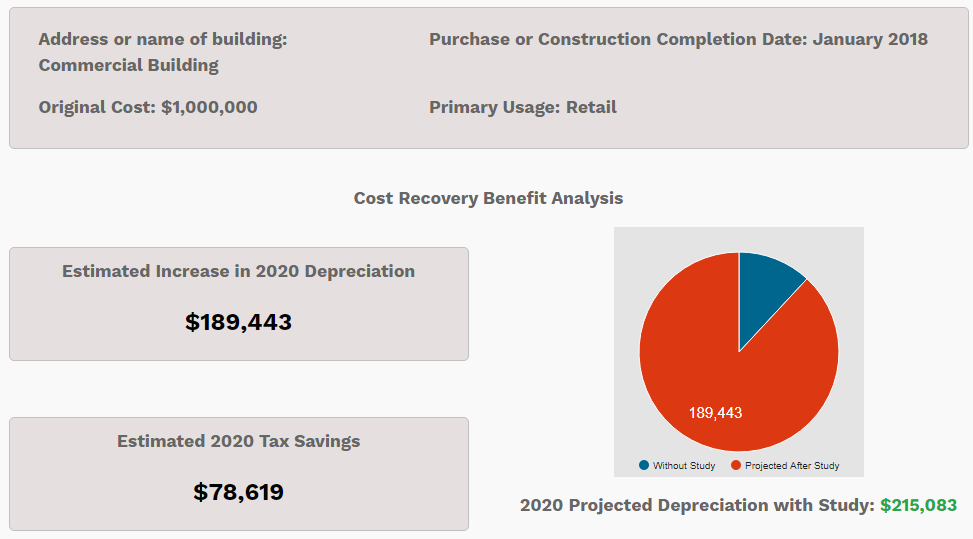

• Below are sample study results from our calculator for a $ 800,000 retail building that went online in January 2018. The tax savings in 2020 will be approximately $ 63,000.

Who is a Good Candidate for a Cost Separation Study?

• Any taxpayer owner of a commercial property can potentially benefit from a cost segregation study.

• With the 100 percent bonus depreciation allowance expiring in 2023, it is more important than ever to consider a cost segregation study.

Try our calculator, or let’s do a free cost segregation feasibility study to determine the potential benefits of a cost segregation study. For more information on our cost segregation services, see http://www.beachfleischman.com/costsegregation or contact Ashley Byma at [email protected].

Ashley T. Byma is BeachFleischman’s Senior Tax Manager and a licensed Chartered Accountant in Arizona. In addition to running the company’s cost separation service line, Ashley provides accounting and tax services to a variety of private companies.