WASHINGTON, DC – APRIL 15: The Internal Revenue Service (IRS) building stands in on April 15, 2019 … [+]

Getty Images

How do you feel about taxes? Are They a Necessary Evil? Maybe an obligation? A civic duty? Regardless of your point of view, taxes will most likely rise in the not too distant future. Once we get out of the grip of Covid-19, Congress and President Biden are ready to hike rates once the economy has stabilized. Even without the president’s proposed tax hikes, individual income tax liability is expected to rise 66% by 2031, according to a recent report by the Congressional Budget Office. The CBO projection is based on current tax law, which can change if President Biden’s tax increases are implemented. Why should taxes go up? Look no further than the federal budget.

Federal government: income or expenditure problem?

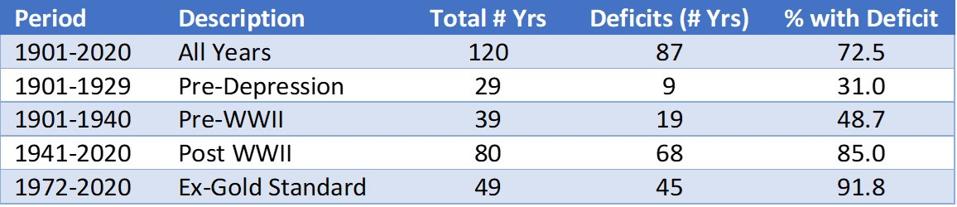

The federal government, and especially those we elect, are tasked with overseeing the state budget. In the 120 years since 1901, the federal budget was in deficit in 72.5% of these years. In the early days of the 20th century, the federal government only overpayed during war or to deal with a crisis. From 1901 to 1929 the federal budget was in deficit in only 31.0% of the cases. After President Nixon removed the US from the gold standard in 1971, 91.8% of all cases ran into budget deficits. The following table provides more details.

Federal budget deficits – Different periods from 1901 to 2020

MJP

Why have budget deficits been a regular occurrence since the gold standard was lifted? Removing the US from the gold standard will allow the federal government to spend more as the money supply is no longer constrained by the amount of gold it owns. In other words, the federal government can print as much money as it wants. This excessive spending has created larger deficits and sovereign debt, increasing the likelihood of higher taxes in the future. Some say higher taxes are a necessity.

The taxes are higher

For the past 20 years, the US has seen a stock bubble, a housing and financial crisis, and now a global pandemic. As mentioned earlier, crises create deficits when the government tries to solve the problem. Without a gold standard, however, the nation’s checkbook is more accessible to reward political allies as well. In view of the increasing frequency of crisis events and today’s political attitudes, future deficits and rising national debt are not a matter of course.

At the end of fiscal year ended September 30, 2020, national debt was nearly $ 27 trillion, $ 21.2 trillion more than the $ 5.77 trillion recorded in 2000. In fact, the federal budget has been in deficit every year since 2001 There are three ways to pay off the debt. They can grow the economy, collect taxes, or default on the debt. The answer will likely be a combination of the first two since standard is not an option.

How will the individual income tax liability increase over the next 10 years? The graph below shows the projected percentage increase in individual income tax liability through 2031. Note the increase in 2026. This year Trump’s tax cuts are slated to expire, but it is doubtful that the tax cuts will survive the current administration.

CBO: Individual Income Liability Projection 2019 to 2031

MJP

Get ready for higher taxes. Congress has spent too much for many, many years, and the US continues to face one crisis after another. The government’s power to collect a tax and the taxpayer’s ability to pay the tax are of paramount importance. When taxes become so burdensome that they harm the worker, the whole system can come under severe pressure. The longer we wait to fix the problem, the harder it will be to fix it.

While individual income tax accounted for 47% of total revenue in 2020, corporate income tax accounted for only 6.8% of federal government revenue. Why not levy taxes on companies? Why not let them pay more? The argument is that companies have to compete with companies around the world and tax increases would cause them to move to another country. Do you remember tax reversals?

This discussion continues and is likely to grow in the years to come. I remember a quote from Mark Twain: “What is the difference between a taxidermist and a tax collector? The taxidermist only takes your skin. ” And so it goes.