In the latest marijuana market update, I’ll cover:

- A question about buying cannabis stock options.

- Why taxes could hinder the legalization of cannabis at the federal level.

Jim sent me an email to say:

I’m enjoying Matt’s results in the cannabis market and I’m glad I joined the community as a premium member. I would like to hear Matt’s thoughts on options on cannabis stocks. Thanks very much.

Thanks for the question, Jim. Keep an eye out; My team will contact you to send you cash and market loot.

Options on cannabis stocks

When it comes to updating, there are two main types of options that you can buy:

- Call Option – Gives you the right to buy a stock at a predetermined price in the future.

- Put Option – Gives you the right to sell a stock in the future at a predetermined price.

The beauty of buying call or put options is that you limit your losses to what you pay for. Call options have an unlimited maximum profit potential, while put options have a limited maximum profit.

Call options are a bullish view of the underlying asset, while put options are bearish.

Buyers of call options expect the share price to be equal to or above the exercise price of the option.

Buyers of put options expect the share price to be at or below the strike price.

Of course, there’s a lot more to it than that, but those are the broad lines.

I recorded an episode of Ask Adam Anything with our chief investment strategist Adam O’Dell about making money with options. (You can watch the video here.)

In that video, Adam mentioned a number that you should know before buying an option: the implied volatility.

This is the annualized volatility that investors expect in the stock. It is a factor in the price of an option.

Before buying an options contract, you should compare the implied volatility with the historical (or actual) volatility.

An option is undervalued if the historical volatility is higher than the implied volatility.

Above is an option table for GrowGeneration Corp. (Nasdaq: GROUP), one of our cannabis watchlist stocks. The options expire on January 21, 2022.

You can see that each option has a different implied volatility. Compare that to the historical volatility of 84.7% to find an undervalued options contract to buy.

Well, there is a little more than that, but this will get you started.

As for the cannabis options I think you should buy, it all depends on whether you are bearish or bullish on cannabis stocks. Then of course you need to determine how bullish or bearish you are.

I’m not recommending options for the cannabis watchlist, but I’m ready to look. If you have a stock to check for options contracts, email me at feedback@moneyandmarkets.com.

But remember that playing with options isn’t as easy as buying and selling stocks.

Again Jim, thank you for your question and for joining our exclusive membership program on YouTube.

Look out for an email from my team so we can send you Money & Markets merchandise.

You too can get Money & Markets swag by sending a question to me, Adam O’Dell or Charles Sizemore, which we use in each of our videos. Just send us your questions and feedback.

Taxes and the cannabis industry

Now for cannabis legalization.

Death and taxes: the only things that are guaranteed in life.

For the cannabis industry, taxes have a completely different meaning.

Because it is illegal at the federal level, cannabis companies are taxed under a provision of the U.S. Code that does not allow them to deduct much of their normal business expenses.

Most cannabis companies pay around 60% in taxes, according to New Frontier Data, a cannabis data research company. Compare that to the standard US business tax rate of just 21.5%.

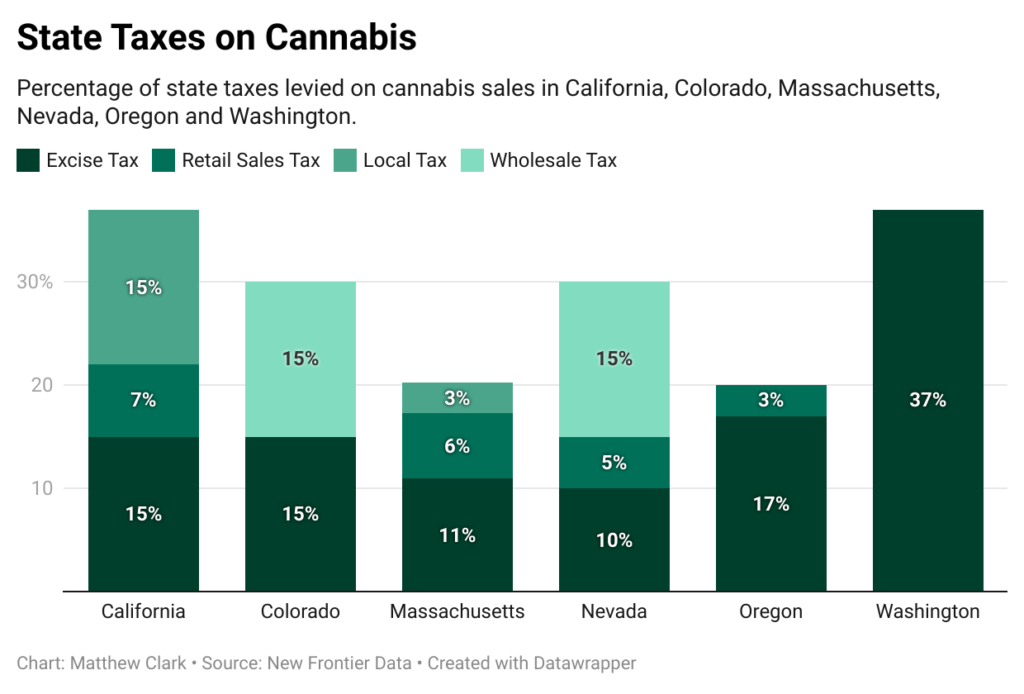

As you can see from this graph, these higher taxes are passed on to consumers who pay up to 37% tax in states like California and Washington.

Consumers who buy cannabis do not seem to mind the higher taxes as cannabis sales continue to rise across the country.

Under the proposed Cannabis Administration and Opportunity Act, cannabis would essentially become a legal business and corporations would not be subject to the same taxes as now under the U.S. Code.

However, this can hardly bring any relief to cannabis companies in the United States

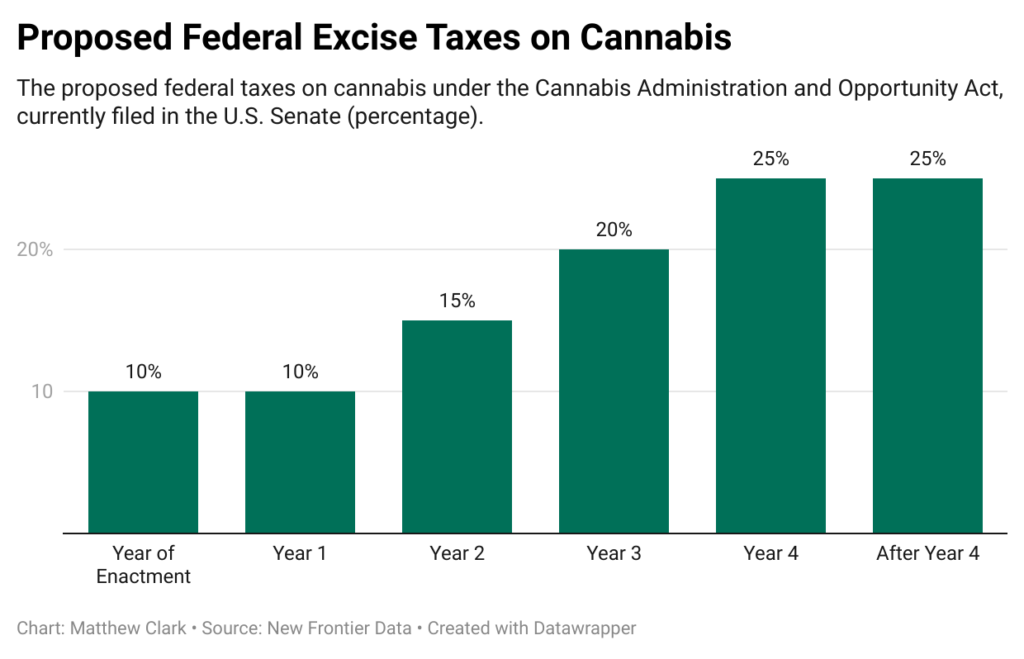

Under the proposed bill, which is in the US Senate, companies would pay federal excise tax.

Transactions between producers and processors as well as producers and retailers are subject to consumption tax (according to New Frontier Data).

You can see the suggestion in the table above.

If the invoice is accepted in its current form, and I doubt it is, the excise duty will be 10%.

It goes to 15%, then to 20%. After the fourth year, this excise tax will be capped at 25% of the applicable US sales price per ounce of THC.

New Frontier Data noted that under the proposed legislation, the cannabis industry would face higher taxes than it is now.

The big picture: cannabis taxes

Corporations pay high government taxes – one of the selling points for legalization. The introduction of a high wholesale excise tax is doing cannabis companies no favors.

It has the potential to make it difficult for small cannabis operators and to hamper potential investment and innovation.

The wording in the proposed legislation is slick, suggesting that cannabis companies will receive a “tax credit”. Companies with less than $ 20 million in revenue receive a 50% tax credit, while companies with more than $ 20 million in revenue receive a credit on the first $ 20 million in revenue.

However, in order to receive the credit, companies will still have to pay the full amount until the credit is claimed – in some cases, this can be a year after filing the tax return.

Businesses will pass higher taxes on to consumers in the form of higher retail prices.

This poses a bigger problem as the legal market faces headwinds from the illegal market. Higher retail prices for legal cannabis could push some buyers into the cheaper illegal market.

This proposed tax structure also treats all cannabis companies equally. However, many cannabis operators operate under a structure known as vertical integration in which they acquire or set up their own suppliers, distributors, retail locations, and more. This proposed tax structure takes away the cost efficiency advantage of this model.

What this means for cannabis investors is still very early in the legislative process – the bill has not even been heard on subcommittees.

If the law is passed, I doubt it will be in its current form. We’ll keep an eye on whether the Senate is looking into the tax structure.

Before I unsubscribe, one more note: We have scheduled our next live chat on YouTube for Thursday, September 9th at 4 p.m. Eastern.

You can go to YouTube and ask me about cannabis stocks and the wider cannabis market, as well as potential legalization.

We offer members exclusive content including:

- Interviews with cannabis insiders.

- Blog posts, stock research, and corporate breakdowns.

- More content on our cannabis watchlist.

- Monthly live chats with me discussing cannabis stocks, the cannabis sector, and more.

I even featured another tool that you can use to point you in the right direction when investing in cannabis stocks.

Just click “Join” on our YouTube page to find out what you can access by participating.

If you’ve got a stock of cannabis to check out, email me at feedback@moneyandmarkets.com.

Where to find us

This week we’ll have more about The Bull & The Bear Podcast and our Money & Markets Week Ahead, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series where we ask all the questions to chief investment strategist Adam O’Dell and our Investing With Charles series where our expert Charles Sizemore and I discuss the trends you are writing about To ask about.

You can also follow me on Twitter (@InvestWithMattC), where I’ll give you even more insight, not just into the cannabis market.

Remember, you can email my team and me at feedback@moneyandmarkets.com – or leave a comment on YouTube. We are happy to hear from them!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is a research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst at the Corporate Finance Institute and an employee of Seeking Alpha. Before joining Money & Markets, he worked for 25 years as a journalist and editor for university sports, business and politics.