It’s tax time again, no need to be reminded of it. It pops up at the same time every year, ready, willing, and able to take you on a financial memory trail.

When it comes to filing income taxes, this year more than any other is likely to throw some curveballs. There were stimulus payments and employment payments; You may have had more or less income than the previous year. Sad to say, bankruptcy, the death of a loved one, or job loss may affect your financial situation more than ever in your personal history this year. Your tax software must be up to the task of receiving every possible tax break.

We’re going to look at the three most important aspects of online tax filing: TurboTax, H&R Block, and TaxAct. All three offer a standardized set of functions that allow you to take care of your taxes quickly and easily. However, they each offer unique benefits that could be better suited to your specific filing needs for the 2020 tax return season.

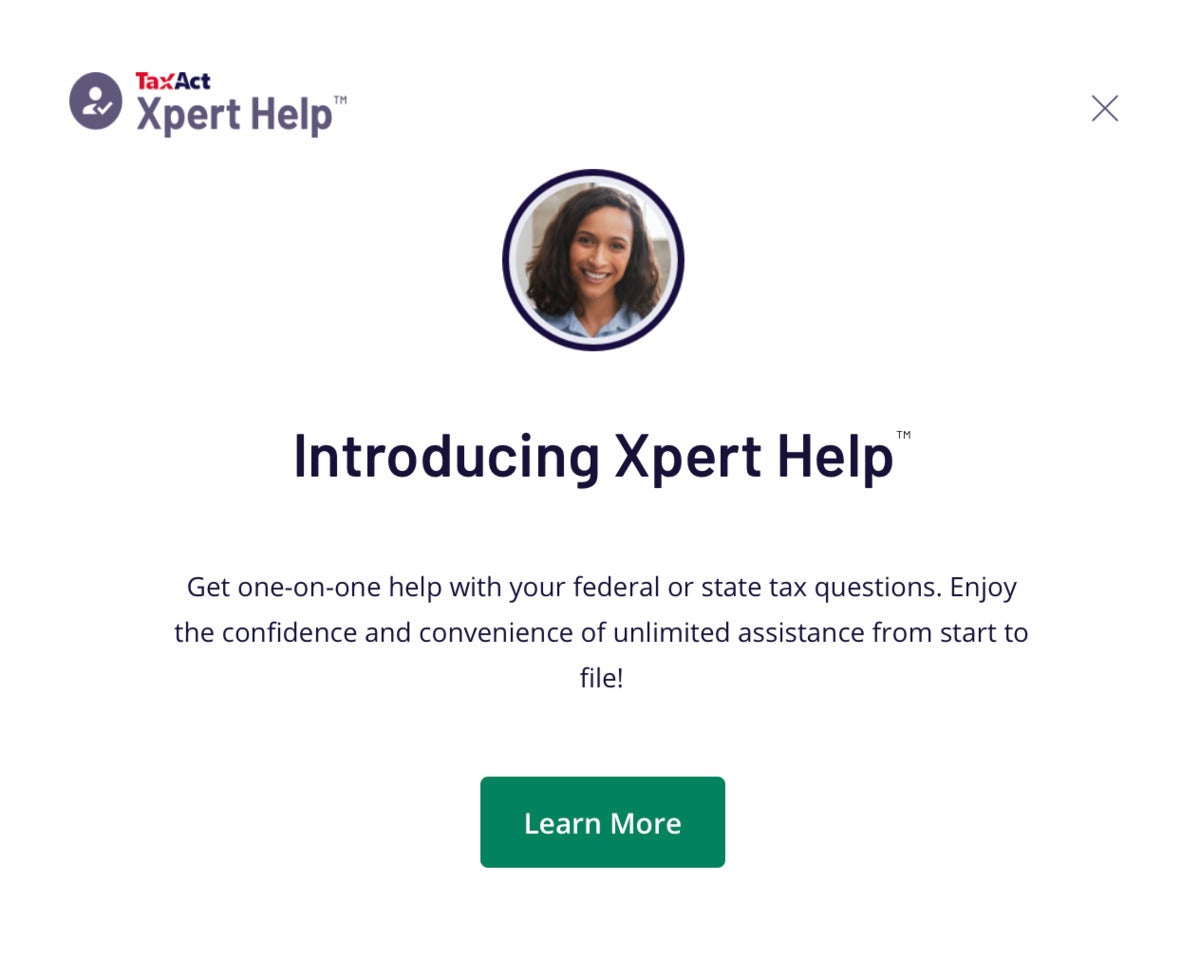

In addition, all three tax preparation services offer the opportunity to sit down with a tax advisor without ever leaving your home. This feature is new to TaxAct this tax season, but both H&R Block and TurboTax have offered this option for a number of years.

Note that all prices quoted for each of these products were the same as they were at the time this article was written, and each company charges more the closer you get to April 15th. So don’t wait!

TaxAct review

Inexpensive, easy to use, TaxAct is the product I have used for both my business and personal taxes for the past several years. It’s the only online tax filing program that allows you to file corporate taxes, and it can also import information from your K1 directly into your personal income tax return.

The first interview with TaxAct starts on the sales screen where you select the package you need to file your taxes. TaxAct offers four tiers of personal tax, from a free filing option that costs nothing to qualified applicants to a standalone option that costs $ 65. In addition, TaxAct now has a feature called TaxAct Xpert Help that allows you to consult a tax advisor for an additional $ 35 per tax return. No matter what, if you are in a state where you must file taxes, you will have to spend an additional $ 20 to file your state tax return.

Together with the competition, TaxAct offers live support as an option for its online service.

The process

If you have used TaxAct in the past, your tax return from the previous year will be imported into your new tax return and you will be asked to confirm the accuracy of your personal information. First-time TaxAct users must go through the process of adding personal information before they can begin a return.

Next, the program begins collecting your financial information, starting with your income. The TaxAct interview process consists of a series of questions that you answer by checking boxes. Do you have a W-2? Check. Rental income? Check. Did you receive a 1099? If so, what types of 1099 did you receive? And so it goes on until you have answered each of the questions that are right for you.

Once you have completed this first interview, you will be given the opportunity to share your personal information with TaxSmart Research, LLC, a TaxAct sister company, who is keen to sell you more related features and options. I recommend you skip this, but read the details to see if it makes sense for you.

Conclusion

There is nothing special about the TaxAct interface. It’s just one step ahead of the other, but while it’s not as snug as TurboTax and H&R Block, it doesn’t really need it. All of the information from TaxAct is well organized and easy to understand so that you can go through the process with ease.

H&R block review

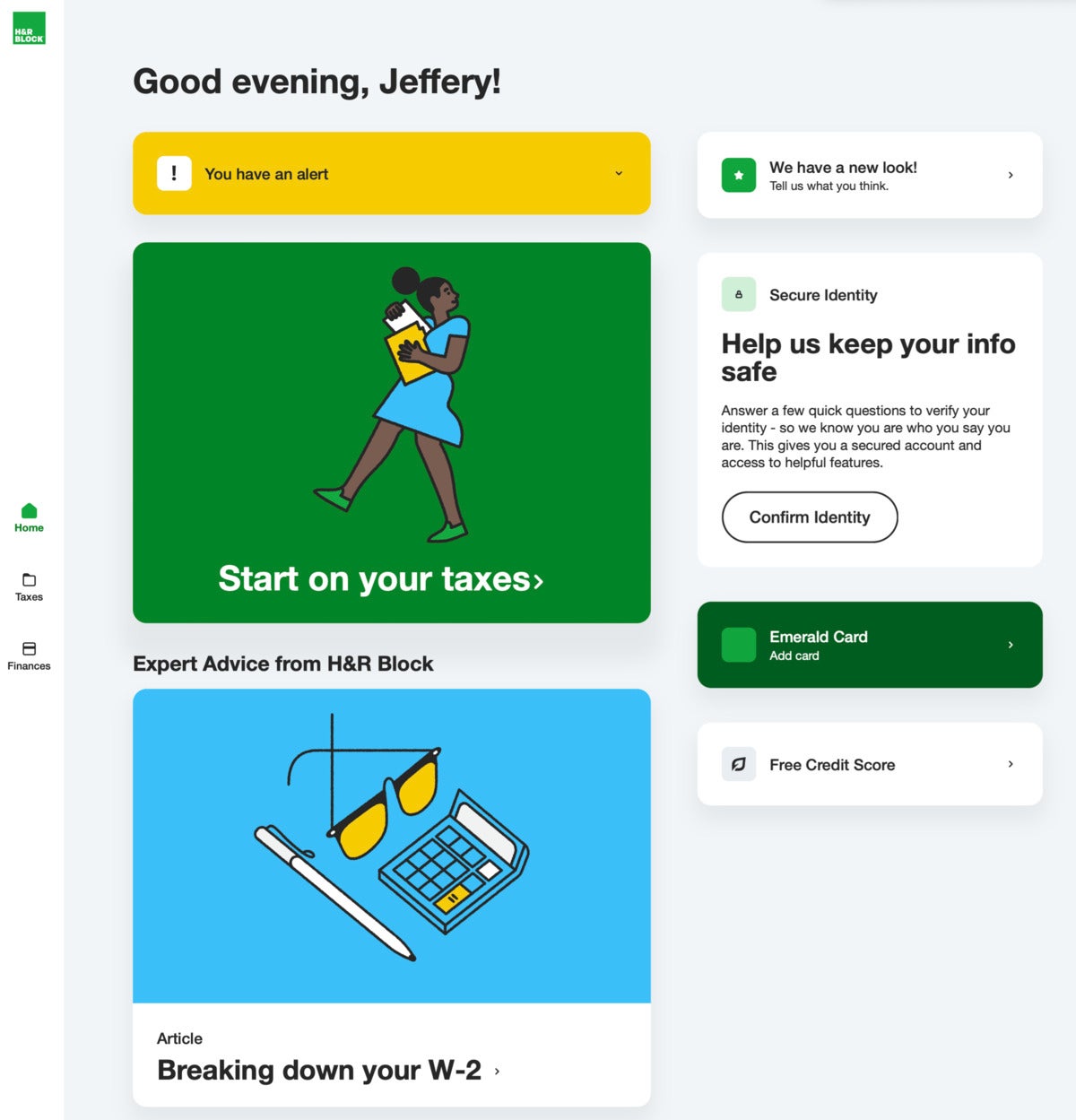

H&R Block has a completely new look. In a nod to Intuits TurboTax, H&R Block now looks a little less corporate and a lot happier, which may only take the burden off paying your taxes. I really like the new redesign, not only because it looks good, but also because it seems easier to use than I remember from previous versions.

As mentioned earlier, H&R Block has long offered the opportunity to work with a tax professional on filing your taxes. In this year’s version of the online app, you will first be asked whether you would like to submit your taxes yourself or whether you would like to employ a tax advisor. Since H&R Block has stationary locations, you have the option, as always, of working virtually with a professional, or you can choose to be with them in person at your local Block location. Note that you can always hire a tax advisor, even if you have started collecting your taxes yourself.

The cheerful new design from H&R Block.

The process

Once you’ve chosen your filing option, the path forward is pretty simple: fill in your information one step at a time. H&R Block starts the process with a quick question and answer about COVID-19 and how it could affect your 2020 tax return. H&R Block’s answers to these questions are excellent. Be aware, however, that if COVID-19 has complicated or absent your income, it is likely in your best interest to consult someone who is familiar with all the rough edges of the latest tax law. whether it is one of H&R Block’s tax experts or someone close to you who may also be familiar with your state tax laws.

H&R Block offers five separate options for filing your taxes, from a free version to a standalone version that costs $ 85. Block’s two most affordable options, Free and Plus, also offer a free tax return. At all other tiers, you must pay to file state taxes. Also note that if you were self-employed in 2020 and want to report corporate deductions or claim your small business expenses, then use the $ 85 package.

Like TaxAct, H&R Block wants you to sign a waiver that allows one of the Block affiliates to see your financial information so they can sell you stuff. Again, unless you see something that interests you, I recommend that you skip this and proceed with filing your taxes.

If you have previously submitted taxes to H&R Block, you can import and confirm the accuracy of this information. Otherwise, systematically enter your personal and financial information for convenience.

Conclusion

In particular, the redesign of H&R Block is a significant improvement over the previous version. Easy to read, clear, simple, and logical processes help make this a great new change to what was once an excellent product but not that fun to look at or work with. Hats off to the new H&R Block design team.

TurboTax review

TurboTax is for sure the biggest name in do-it-yourself tax return software. Probably the first software you used to file your taxes and probably the one you still use today, for good reason. As I’ve said over the years, somehow Intuit found a way to make you feel more comfortable running your taxes.

As with every application we’ve looked at this year, TurboTax offers the option to contact a tax advisor. However, if you file your taxes by March 27th and qualify for the free tax return, you can contact a tax advisor for free. TurboTax now also offers the option of having your taxes done for you by a tax expert. Up until now, TurboTax only offered the option of having your taxes checked by a specialist.

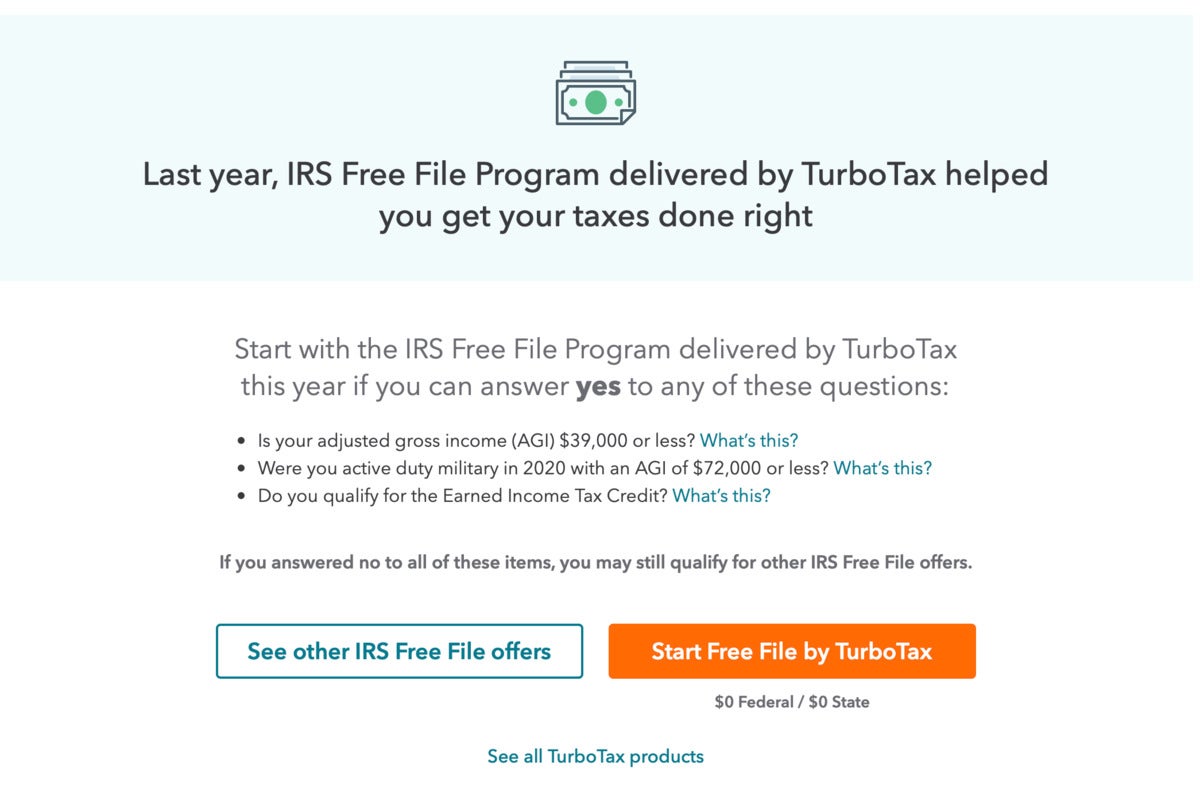

Also noteworthy is that Intuit, which got hammered last year for dealing with free sign up options, this year makes it very clear what you can file for free on TurboTax Online and gives you a link to the IRS website to find out who you are will file your taxes for free if you can’t file them with TurboTax Online. And there’s one important note to keep in mind with TurboTax: You can only file for free if you have an adjusted gross income of $ 39,000 or less, or $ 70,000 or less if you are in the military on active duty. (Unlike the IRS, which lets anyone create $ 72,000 worth of files for free. So TurboTax buyers, be careful.)

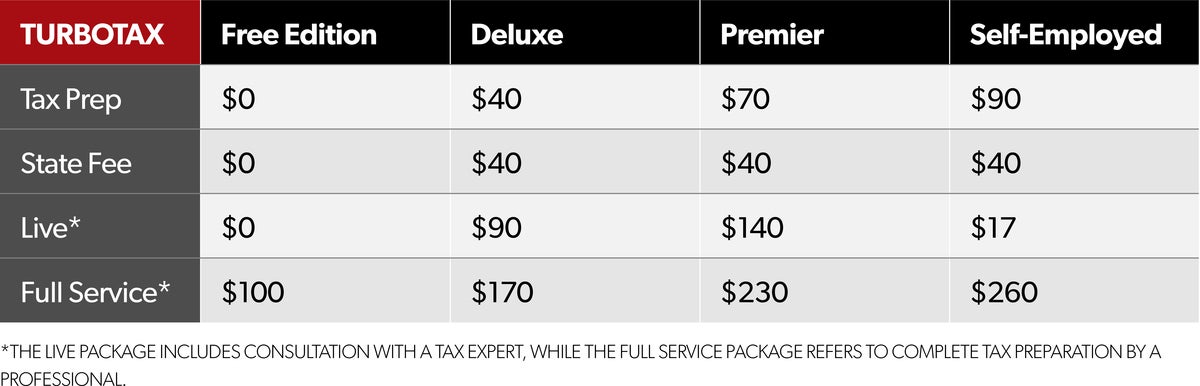

TurboTAx is the most expensive of the three tax services tested here and offers four packages priced between free and $ 90. Fortunately, Intuit did away with the 0.99 ¢ pricing scheme and rounded the prices up to the nearest dollar.

TurboTax is much more open to the free files option after it broke for bypassing that requirement.

The process

Intuit’s interview process is the best in personal taxation and is further enhanced with the latest online version of TurboTax. In addition to the excellent and easy-to-understand interview process, TurboTAx provides more details, and in some cases even detailed videos, when answering an interview question that may require special attention, such as: B. Paying as a 1099 Contractor You understand the tax implications and how to properly account for that income and related expenses. Overall, this is a great addition to an already excellent product.

A big advantage of TurboTax Online is the ability to import data directly from QuickBooks Self-Employed. Intuit has changed the price structure slightly compared to previous years. It used to be that if you bought one you got the other for free. Now you can buy QuickBooks Self-Employed as a standalone package, or buy TurboTax for a few dollars more per month with QuickBooks Self-Employed, which allows you to use TurboTax to pay your quarterly taxes based on your work information right from the app. That alone is an excellent feature that is well worth the price of admission.

Conclusion

TurboTax remains the gold standard in online tax preparation software. While the competition is tough on its own, loyal Turbo Tax users have no reason to switch camp unless they fall into a niche tax scenario that is better served by another product.