introduction

Higher income individuals or couples may find that their tax returns have been filed in the AMT zone. The law was enacted in 1969 after the Treasury Secretary testified that more than 100 people with adjusted gross income greater than $ 200,000 had not paid federal income tax on their most recent returns. The aim was to guarantee everyone that they would pay an income tax.

Before we get into the CEF, which is designed to avoid the alternative minimum tax known as AMT, let’s briefly examine what it is about.

The Tax Policy Center defines the AMT as follows:

The individual alternative minimum tax (AMT) applies in addition to the regular income tax. Some taxpayers have to calculate their liability twice – once under regular income tax rules and once under AMT rules – and then pay the higher amount. Originally intended to prevent perceived abuse by a handful of the very wealthy, the AMT affected around 5.1 million claimants in 2017. The Tax Cut and Jobs Act drastically reduced the scope of the AMT, if only temporarily, so the tax will only reach 200,000 applicants in 2019.

Source: Taxfoundation.org

The site provides the following history and a table showing the number of returns affected.

Congress passed the modern alternative minimum tax (AMT) in 1979 to work in parallel with the additional minimum tax. The main preferential items, including capital gains, were transferred from the surcharge to the AMT. Congress eventually repealed the surcharge that came into effect in 1983.

The original minimum tax and the AMT affected fewer than 1 million taxpayers annually until the late 1990s. In 2001, Congress passed the Economic Growth and Tax Relief Act, which significantly reduced regular income taxes but only provided temporary relief for the AMT. Over the next decade, Congress repeatedly passed legislation, often at the last possible time, to temporarily “patch” the AMT by increasing the AMT exemption amount.

Although the patches prevented an AMT explosion, the number of taxpayers affected by the AMT continued to grow throughout the decade (Figure 1) because (1) regular income tax was indexed for inflation but the AMT was not; and (2) Congress passed substantial cuts in regular income tax.

The American Taxpayer Relief Act of 2012 introduced a permanent AMT fix by setting a higher AMT exemption amount, indexing AMT parameters for inflation, and allowing certain tax credits under the AMT. As a result, the number of AMT taxpayers fell from 4.5 million in 2012 to around 4.0 million in 2013. That number rose slightly to 5.1 million in 2017.

The Tax Cut and Employment Act (TCJA), passed in 2017, drastically reduced the impact of the tax by introducing higher AMT exemptions and a large spike in income at which the exemption expires. The Tax Policy Center estimates that the number of AMT taxpayers fell to just 200,000 in 2018, but will rise again after the TCJA expires in 2025, as will regular income tax rates.

Tax-free bonds and the AMT

Muni Bonds, which are considered a “private activity”, are subject to taxation for AMT taxpayers. Bonds issued for purposes as diverse as healthcare, housing, airports, and soccer stadiums fall under this heading. FINRA regulations require AMT disclosure to such investors. While the AMT calculation includes the interest on these bonds, regular taxpayers are not subject to taxation on their AMT bond income. In the years immediately prior to the implementation of the new tax law in 2018, the yield distribution between AMT and non-AMT bonds varied between 0.15% and 0.75%, according to Wells Capital. I suspect the gap has narrowed since then. Since AMT-free municipalities generally have a lower income return than a similar AMT bond, logically only those who expect them to meet AMT rules would want to consider this or this CEF.

Exploring the Nuveen AMT Free Quality Municipal Income Fund (NEA)

The Fund seeks to achieve ongoing income that is exempt from regular federal income tax and Individual Alternative Minimum Tax (AMT) by investing in an actively managed portfolio of tax-free municipal securities. Up to 35% of assets under management may be rated BBB and below at the time of purchase or, if unrated, may be of comparable quality by the fund’s portfolio team and the fund uses leverage.

Source: Nuveen.com

Basic important information:

Net worth: $ 4.4 billion

Current discount: 6.86%

Leverage: 37.54%

Fees: 2.4%, including 1.47% leverage interest

Return on Price: 4.75%

Average bond price not equal to zero / face value: 102%

Effective term: 18.58 years

Leverage-adjusted duration: 10.44

Source: Cefconnect.com

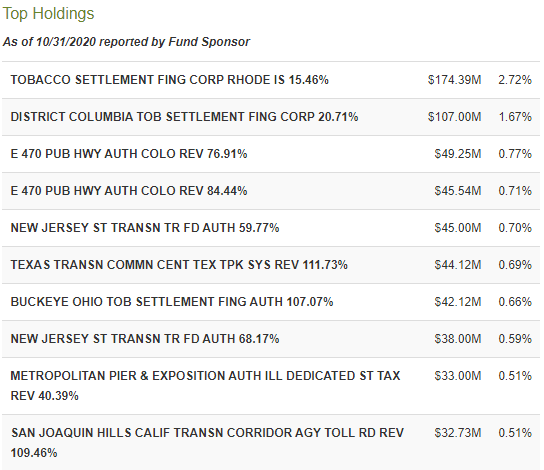

Do you remember the big tobacco settlement states? Three of the largest investments are funded through these payments. Almost all of the remaining top 10 stocks relate to transport projects. Here on the east coast, the states have increased the tolls to compensate for the lower volume of traffic. The proceeds were used to pay the interest on these bonds.

Source: Cefconnect.com

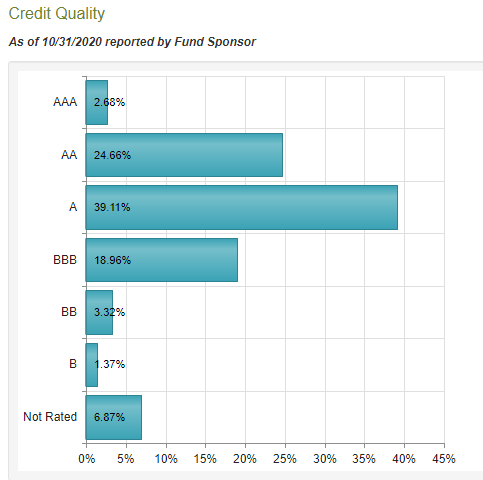

An important consideration in any bond fund is the quality of the bonds it holds. The graph above shows the distribution with an investment grade of 76%. Morningstar assigns a BBB weighted rating to NEA’s holdings.

Source: Cefconnect.com

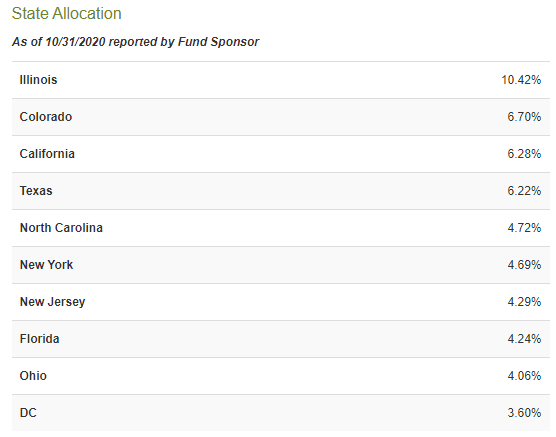

State allocation is important as any bond issued by your home state is also exempt from state taxes. Given that Illinois has one of the lowest ratings on government bonds, a closer look at these holdings would be prudent. Given the rating distribution, the bonds actually owned could have better ratings. About 40% of the bonds are callable in the next four years.

performance evaluation

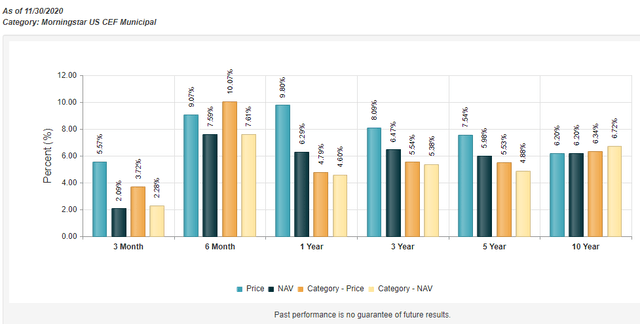

Source: Cefconnect.com

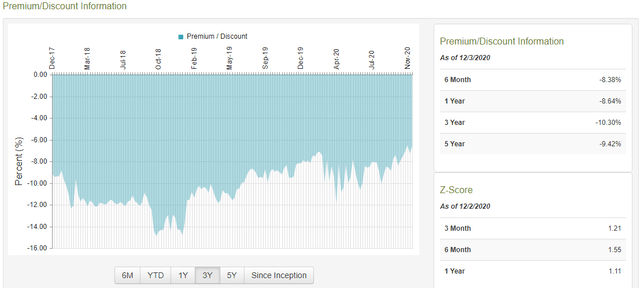

While buying with a discount is preferred to the price, the current discount is below all given average values and this is reflected in its positive Z-Score. This doesn’t mean it can’t continue to shrink, but NEA hasn’t sold at a premium since the end of 2012 either. I’m saying all this because some CEF buyers are looking for an improved ROI that comes from the decreasing discount.

Source: Cefconnect.com

With hundreds of Muni funds to choose from compared to its competitors, NEA can decide if this is the one they want to own. While NEA has lagged behind its competitors in the long term (10 years), it has performed superiorly for most of the past five years.

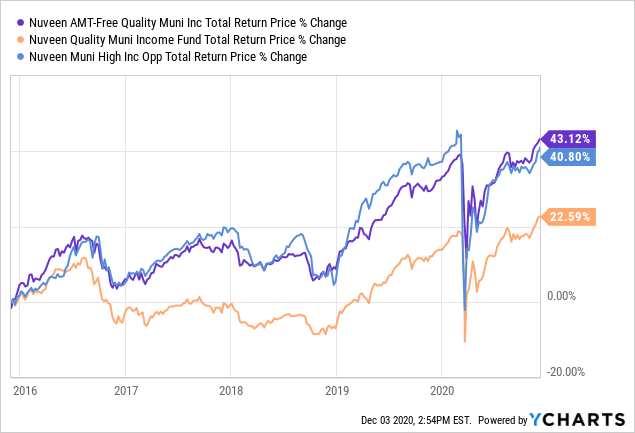

Data from YCharts

Data from YCharts

I mentioned earlier that NEA is for investors faced with paying the AMT, and such bonds have lower coupons. That is, the return on a similar quality Nuveen fund (NYSE: NAD) shows that the CAGR can easily make up for this difference. NEA’s CAGR was also a good fit with investors who chose Nuveen’s HY Muni bond fund (NYSE: NMZ).

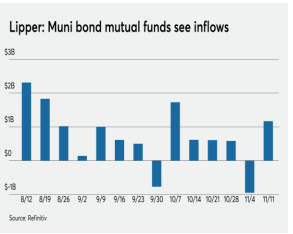

Together with interest rates (historical lows), inflows into Muni funds can affect bond prices and thus the net asset value of all of these funds.

Source: RWB

These have been positive for most of the weeks since August, a good sign of investor demand. There is concern that AMT limits could be reduced under the Biden administration before 2025, which could fuel recent demand.

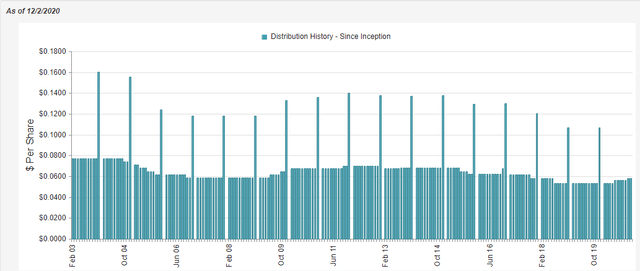

Source: Cefconnect.com

Lower interest rates have led NEA, like most pension funds, to cut their distributions. Surprisingly, since last spring, many of the Nuveen funds, including the NEA, have started increasing their payouts. NEA pays monthly, except in December, when the distribution takes two months, i.e. the tips and spaces.

Conclusion

A look at the full inventory report shows that Illinois exposure tends to be at hospitals and state universities. Both are going through interesting times with the virus affecting their businesses, but many bonds have had at least an A rating. For bonds that are currently selling on average above par, the damage can be limited as interest rates rise. Until that happens, when the economy strengthens, which should lead to an improvement in revenue streams, which leads to an improvement in bond ratings, which in turn would offset the fall in prices caused by rising interest rates.

Given the above and the fact that NEA’s five-year returns are the same as those of the higher risk NMZ CEF, I am giving NEA a bullish rating. Since it also significantly outperformed its sister-quality Muni fund, I’d say it’s a buy, even for investors who aren’t at risk of hitting the AMT swamp.

In my last article on NAD, I explain several factors influencing the municipal bond market. Here is a link to that article.

Full NEA Holdings Report: Holdings

Government bond ratings: Link

Nuveens Muni Market Outlook: Link

If you appreciate articles of this nature, please mark them as “Like” and click the “Follow” button above to be informed of my next submission. Thank you for reading.

Disclosure: I am / we are NAD for a long time. I wrote this article myself and it expresses my own opinion. I don’t get any compensation for this (except from Seeking Alpha). I do not have a business relationship with any company whose stocks are mentioned in this article.